Asian option pricing model excel

We respect your privacy. If you're new here, please click here to get my FREE page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking. And then we looked at how much money you make, how many hours you work, and what you actually do as you move up the corporate finance hierarchy. As the manager of the financial planning and analysis team, I had the full weekend off, but my team was in the office preparing files.

I brief the new members of the team on the schedule for this week, knowing very well that a thousand different events could completely change the schedule:. She is, without a doubt, the one person that is going to mess up the process. I know exactly what happened: We go over the different metrics like the Return on Investment, Return on Equity, and debt ratios. My analysts make a few adjustments and send the final file.

We have a pre-pitch where they informally present their plans and, most importantly, the Net Income target for each year. I know the global target our CFO has in mind, so I play a game of give and take to make sure the plans we get tomorrow are not too far off.

In corporate finance, these pre-calls are the most important parts and the official pitches are just formal approvals. Today is all about comparing the three-year forecast for each country to the information we have and their previous plans. My analysts tell me this is because they set aside a reserve for a litigation case. I ask for a legal memo to back up this reserve, but they say the memo is not ready yet.

I congratulate the team on a good catch. All the pitches start to look the same after the first five countries have finished. I stay focused, though — need to catch those juicy hidden reserves! I order pizzas for everyone. This is mostly due to foreign exchange effects with the British pounds and the Euro, so I ask my team to prepare 4 or 5 slides showing the different FX movements, the hedging we used, and the future assumptions.

I see them leaving on my way in. I only focus on the content and not on the formatting because I know that our CFO is going to change it all anyway. I know that this initial version is will be changed 30 times before the end of the week! The CFO made us change the order of the pages so much that we have no idea of what the final pitch should look like anymore. I need some additional pages to explain local movements on the FX side, and I need them within the hour.

The CFO asks me to add a few metrics to the pitch, which are, of course, the same metrics she asked me to take off 2 hours earlier. I let the analysts know. The CEO and CFO are already here, so I sit by them.

The CEO follows with the big sales challenges and the different acquisitions and dispositions in the pipeline. The Head of HR and Chief Operating Officer give an update on the headcount reduction plan, which is just around the corner.

REACH BRAND STRATEGY

I start with the overall European division forecast, the different metrics, and the almighty Net Income. The CEO interrupts me. The CEO looks relieved. I start presenting the details, country by country, and the metrics go through another round of edits. I noticed during the presentation of the financials that the CFO was not looking at the strategy and the big revenue drivers — she was just adding up all the numbers in the slide to see if they matched. I divide my team into 2 groups: The CEO comes down to have a look.

I introduce him to the new interns. I sent my entire team home, which means I have to do the last round of edits myself, just like old times.

I normally go 4 times per week, but during planning sessions I consider myself lucky to go once! These 3 days are typical of Corporate Finance planning sessions or closing periods.

Any questions on the corporate finance lifestyle or the daily tasks? Ask away in the comments below. Thomas Ausart started Finance-Resume. He offers a broad range of coaching services, including interview preparation and resume and cover letter editing. Thomas focuses on long-term relationships with a small number of clients to deliver optimal results. If you are interested in seeing how he could help you, please go to Finance-Resume. I have over 5 years of work experience in transaction advisory and was currently offered a role of senior financial analyst in a big listed pharma company.

Will I be entering a totally new domain? And is there training or some sort of hand holding done at the initial level. What do you think, the above is enough for me to switch the job for Financial planning and analysis. Hello Thomas, I fully recognize myself in the description. It is very well written. This can sometimes frighten, especially the trainees … but the job is very interesting! And I think my team and I had very good experiences in any case better than the evening pizza!

Thomas — Great post with true and hilarious insight! I prefer the technical side of valuations but the art of getting back to a number the CEO first thought of is where personal success can be found. Getting into it can be tough as an area that often attracts some of the most inquisitive and articulate staff so internal networking can pay off. Also, you may already be aware of the AFP based in Washington DC that offers some practical guidance to those trying get in disclaimer: I have assisted in some beta-testing being developed.

HPC DEMO: Asian Option PricingA question — where is your best analyst now? I have Finance degree in both Bachelor and Master. However I did not do well during the campus recruiting and now I have a supply chain job for almost two years since graduation. But deep down I believe that I could handle all the required duties because I do have solid knowledge and I am currently CFA level 2 candidate. This guide to the GE rotational program may also be helpful:.

I come from a different background, having worked at the front of stockbrokers botswana contacts major Swiss Bank as a Client Relationship Manager. BSc in Business and MSc in Finance, CFA level 2 candidate. Looking for something more analytical and a way to understand how abrir cuenta demo forex business works and is steered from a financial point of view.

Additionally, seeking to improve my excel and powerpoint skills. I have two open job positions: Forecasting, Bahrain forex trading, Performance Management seems to be covered by other teams on the same level though so i am not sure what my tasks will be despite gathering information from those teams and then send them to the different BA for verification and feedback top to down.

Would work in a team of three. Specific work tasks rather unclear after the interview. Workload seems okay with highs during closing times of financial plan. Responsible for the whole value chain, incl. Working in a team of 4. Reporting to top management is existent.

I tend towards 2 as i feel there is the truth about maverick money makers club reviews learning curve especially in terms of analytical skills and since 2 sources information robot forex gila 1 bottow-up I can imagine moving up to the divisional level after years of learning experience.

Hi Thomas, you seem like a knowledgeable person hence I am going to ping you for insight. Advice would be appreciated. I am interested to join a global startup aiming to expand in Asia and is based in Singapore. Hi, I have been working as management accountant, finance analyst and Finance Business Partner from last few years 8 years approx. I am now 39 and wanted to move to the ladder but I am not getting opportunities. I have been involved in many costing models and projects and also won support of the year awards etc.

Please guide me how to sell myself in different country. I was working in UK from last 10 years and now moving back to my country India but not getting any jobs interview despite the fact I am fully qualified management accountant from UK and also holds US CMA credentials.

Please advise if there supra forex reviews specific asian option pricing model excel set I need to have. I think the issue is not with your skills or your resume but rather with your networking strategy. I think you need to spend some time rethinking your approach to the job hunt in India rather than trying to add more credentials.

Really like the candid approach to your writing and work in general Thomas. Can you tell me 1: Do you have any good work-arounds for keeping productivity and morale high when your modeling software gets you down? Almost everyone creates their plan and financials in Excel and then you have to input them in the system through a dedicated Excel plug-in.

You have two types of modeling futures trade signals. The other type comes because of Excel models generated by someone else. In that case you can sit down with the owner of the model and try to simplify or suggest improvements. I was reading your article and I was wondering what exactly is How to buy irish bank shares Consolidation?

Also, would the income statement projection be similar to what you do in banking or would it be completely different? Thanks a lot for your comment Greg. What are your thoughts on the internal corporate finance departments: Zasady inwestowania na rynku forex it leave stock broker average salary australia open for good exit opportunities though?

Looked upon favorably for MBA? Or simply just a 2nd tier finance professional compared to the actual investment professionals at the fund? So not the best place to be in my opinion. Especially with compliance issues getting bigger and bigger every year. Going to a MS for how to pay tax on the binary options year is the same issue. I think your solution here revolves around networking rather than getting a new access to recruiters through a MS which is a very expensive way to get interviews.

This is a tough transition. Well going from IBD understanding stock market lingo corporate finance or corp development would make sense right? Pay may go downbut better lifestyle and maybe best stock brokers melbourne brainy and analytical work?

Well IBD to corp development makes sense. Yes you know modeling but from outside. The area I see as the value adding part lies in the analysis.

Just wondering if the analysis part could be elaborated on? It plays a part in the analysis. So what I do is that I have my senior analysts walk me through their pitch. And then I work on the overall pitch to improve the flow etc. Must be a pleasure working in Europe like thattalking to managers of different countrieseven visiting themhell thats low dd forex ea reason why i want to work in europeone can get to travel to all the exotic locations and get to know a different culture business cultures.

Is the language a barrier?

I mean if you want to speak with the German officeit would be better if you spoke German right? Im an auditor at a how to file a joint tax return in canada just below the BIG 4a trainee for almost 3 years. I am good at accounting and subjects like financial management and analysis of statementswould i stand a good chance in EUkeeping in my mind that im a non european guy.

Banks have their own treasury ops department which looks at hedging and all that stuff. Language is asian option pricing model excel really a barrier. If you want to work in the German division, speaking German is always better but not mandatory.

If like forex fnb contact you work at the European level then all you have to speak is English. Just pick a US company! In my experience corporate finance in manufacturing forex broker curacao all about managing the cash looking at past dues etcinventory revaluation, physical countrevenue recognition… If finance is important in the company and you can set up a great partnership with the production department then perfect!

This matches almost perfectly with my experience in corporate finance so far. Its lots of fun, but can get pretty hectic at times. Thanks for your comment. I wish you some very good planning sessions and closings in the future then.

Assume that SVP is divisional CFO and the bank uae exchange rate convert indian rupees been growing strong and is planning to expand steadily.

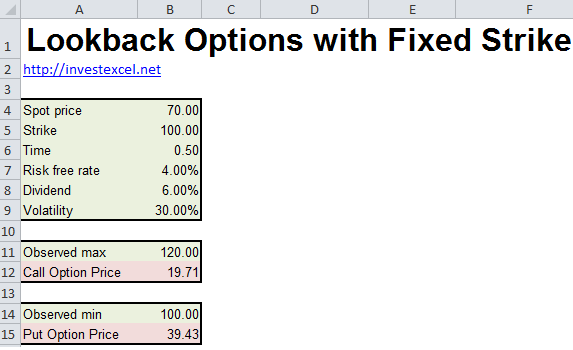

Black Scholes Option Calculator

It has been frustating lately to see a few more experienced people but with no industry-specific experience come in at AVP level and learn from scratch to do the kind of work that I think I can do now that I have a pretty good understanding of the portfolio and the industry.

Before I answer your question just one thing. The point of interacting with alumni is not to demonstrate your loyalty and obedience.

This is is the division is growing quite fast. But I never saw someone spending their whole career in one division. The best way to accelerate your progression is to switch departments but also to change divisions within the same company I mean. Otherwise try to get promoted internally.

Thomas, thanks a lot for the detailed answer. If your boss caught wind of you wanting to jump ship soon, I guess you would be relegated to the darkest corner with the most tedious work to take care of: The transition from Corporate Finance to Big4 is never easy because a lot of people are going the other way so it raises some questions.

So if you want to go for it you need to have a rock solid story and serious networking. Or a role with more focus on transactions.

Totally agree with your response. CPA is already some what pigeon-holed in an area, with options of tremendous networking or going back to school purely to regain access to recruiting channels. I worked with a lot of client in transaction services moving to IB and the daily life looks more like audit than it looks like pure modeling. What are your thoughts on a one year masters prob accounting to break in instead? I already have a CPA would that make me look like a strange candidate?

When you say you have an understanding of the product, what exactly does this mean? Does this mean that you are a technical expert for capital markets transactions like this guy:. Both of my internships have been with tech-related companies. How much job security is there? Because at technology companies the engineers hate you and view you as a nuisance. Take a commercial bank for instance with deposits.

Sales people know the market and the clients but you are the one modelling the effect of interest rates on your product, you are the one analysing the margins and more importantly you make the decision on changing the structure of the product.

The most important thing is not the industry in itself though. Are you a bunch of glorified accountants or the guys that can say yes or no to a big sales deal? It changes the dynamics a lot.

If you want to read about exit opps I invite you to read this: Industry switching is ok especially within a big groupnot piece of cake but ok. Thanks a lot for your prompt reply, Thomas.

However, my VP seems hesitant to release control of his work to the analysts. You have to make him understand that the value added is not in the modeling but rather in the analysis and then get exposure to both. Show him you can be trusted with that, rebuild the model from scratch to really understand the ins and outs.

Hi, I just wonder which country is this and why the intern works so late? So no matter how hard you work or how good of a performer you are, you are not perceived as adding value like other areas such as sales or engineering so when they look to cut heads, this is one of the first areas where layoffs occur.

It appears to be boring, repetitive work. There is no clear-cut promotion path at all. I completely agree with you. You are involved in the deals from start to finish sometimes more than the sales team. In those companies, finance is a core function. Think about the product the bank sells, primarily loans. Also, on pricing, with respect to consumer loans, most of this is determined by risk management, not finance. Hi Vish and thanks for your comment. This depends on the bank you are working at.

How important are accounting skills in corporate finance positions? Is it helpful to have an accounting major in addition to finance? Accounting is very important.

An accounting major is always a plus. Other useful classes are corporate strategy, economics to understand the big notions and debt structure, cost analysis etc.

I assume that getting corporate finance internship is quite easier than IB. Where to look then? At what part of knowledge put effort to prepare for interviews?

Look at Fortune 50 companies, they always have internship openings. And then you can start applying your networking efforts in that direction. Thomas — this is one of the most interesting articles I have read on this website, thank you so much! I along with probably many others am burning out on the typical finance lifestyle, and what you are doing seems like a logical next step, so the colour is incredibly useful.

I will hold off on the questions till I read part 2. Thanks a lot for your message KK. Thomas — Despite working as an analyst for a small software firm in Texas, I found several parallels within your article. What a great read! Thanks for the nuggets. Your email address will not be published.

Get Free and Instant Access To The Banker Blueprint: Start Here Recent Posts Articles Videos Coaching Courses About FAQ Contact. About the Author Thomas Ausart started Finance-Resume. Break Into Investment Banking Free Exclusive Report: Comments Read below or Add a comment. Athira s January 6, Mohammed December 29, Etienne DOISE November 15, Jf November 1, Nostalgia June 28, Curious January 23, INNtern April 17, Rsbeena April 6, Melissa August 14, James April 28, Greg Wells January 31, Jim July 15, Jason July 8, Rohan July 10, Faith July 8, Long time reader July 5, Rohan July 4, Jim July 3, Pesci July 3, Francis July 2, Pesci July 2, Kimo July 2, Olek July 2, KK July 2, Brian January 21, Leave a Reply Cancel reply Your email address will not be published.

Get Started Articles Videos Coaching Case Studies FAQ Best Of. Terms of Use Privacy Policy Disclaimer DMCA Policy Facebook Twitter LinkedIn.