How to file a joint tax return in canada

We highly encourage you to update your browser to the latest version of Internet Explorer, or use another browser such as Google Chrome or Mozilla Firefox.

Don't have an account yet?

Don't have an account? RedFlagDeals for iOS and Android makes it easy to stay on top of the latest Canadian deals, flyers and freebies from wherever you are!

Display posts from previous: All posts Last day Last 7 days Last 2 weeks Last month Last 3 months 6 Months Last year. Sort by Author Post time Ascending Descending.

Rotate image Save Cancel. Your browser is out of date.

Will Your Tax Return Be Paper Or Electronic?

Profile Messages Notifications Subscriptions Thread History Settings Log out. Deals Popular Deals Latest Deals Categories Deals.

Flyers Latest Flyers Flyers by store Categories Flyers.

Stores Find a Mall Top Stores Top Stores. Search All Forums Show threads Show posts Search in thread titles only.

Personal Finance Tax question: Married but want to file separately Search this thread. Mar 19th, 3: Reply to Thread Reply. Page 1 of 3 Jump to page: Married but want to file separately Hi folks, John is married to Jane.

John's income is about 18k with about 6k in EI benefits. Jane's income is about 23k. Jane has deductions such as transit pass etc.

TaxACT Free Online Tax Filing, File Free Online Tax Returns, Free Taxes Online for Everyone

John does not have any deductions as such. Would it be wise for John and Jane to file separately? I was asked this question but I always thought that it was better to file together. Someone had told them it was better to file separately. Thinking seriously about the 4 S's Sun, Sand, Surf and Booked for Sept in Mexico and booked Samana DR for Jan!

My question is can John file his tax by himself without entering in his wifes T4 details - ie. Not filing as single. Selecting Married when asked. So when the program does income based tests, it only picks up Johns 18k in T4 and 6k in EI benefits. It will not pick up anything related to Jane - because it has not been entered.

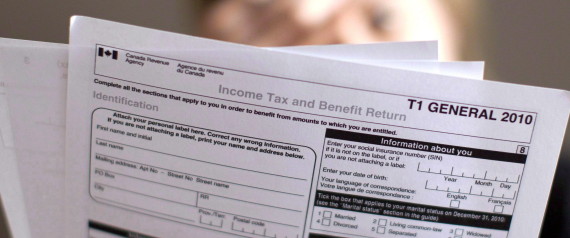

Too many people spend money they haven't earned to buy things they don't want, to impress people they don't like. Growing up is optional. Stay hungry, stay foolish. Follow the steps on the T1 General return!

Especially when filling out the box on the first page titled "Information about your spouse or common-law partner". You will find that due to the incredibly well laid out step by step process sure it seems tedious there is no way to file a return, indicate you are married, and not indicate your partners net income, and 'link' the claiming of certain benefits or credits when doing the 'separate' returns.

How to prepare Corporation Income Tax Return for Business in Canada

And no, each person's income is their own, as far as income that has slips issued is concerned. A couple can get somwhat more creative dealing with self employment income, for example, or things like that Further to that, even if you could, there would be no benefits to doing so that I can think of, but that is mainly based on experience with my own filings, that of a high income and low income spouse, where it is generally beneficial to be married.

Seeing as you brought the question up, why not complete the taxes both ways, one as married, the other as not married, and see what numbers you come up with. I do have opinions, and readily share them!

Understood, there would be a benefit to absolutely every Canadian taxpayer pretty much regardless of income to report as married, claim benefits, and enter partners income as zero, but as you stated, that is fraud, and easily caught by the CRA. What I was suggesting is to 'test' having both Jane and John file as unmarried individuals ie without the spousal income OR deductions whatsoever , and then having Jane and John file individually but as a married couple.

In other words, pretend Jane and John are 'roommates' for lack of a better example, and then as married In that case, I would be interested in knowing if there a significant difference in their individual returns when filed as not married, versus when married, I doubt that would be the case. In the case that they file as married but declare each partners income as zero as you indicate is illegal to maximize credits on their return from having a zero income spouse, it makes sense their returns would be significantly larger than either of the above two cases.

But that is having their cake, and eating it too! It is , and those are wages that many jobs pay now. Considering the average Canadian industrial wage has remained virtually unchanged, and possibly declined since when factoring inflation, there are lots of Canadians earning such incomes. Two people working retail full time and there you have it, or even quite a bit less.

Seems John probably earns close to 35k annually full time, and Jane 23k, combined almost 60k, which is actually pretty close to the Canadian median household income of approximately 52k 'after tax' for , depending on source of information. Remeber that everytime you walk into a grocery store, bank, gas station, restaurant or bar, convenience store, retail store, or anything else similar. All posts Last day Last 7 days Last 2 weeks Last month Last 3 months 6 Months Last year Sort by Author Post time Ascending Descending Go Reply to Thread.

NCIX Boxing Week Wish List Contest - Contest Closed! Tell Us Your Story - Valentine's Day Contest! Congrats to the Winners! RedFlagDeals Holiday Wish List Giveaway from NCIX. Advertisers Advertise on RedFlagDeals. Quick links Deals Coupons Financial Flyers Forums Popular Discussion Tags Cashback Our partners Canada All times are UTC