Foreign exchange rate regimes

Ghosh and Jonathan D. A new look at an old question: Should countries fix, float, or choose something in between? A PERENNIAL question in international economics—whether in academia or in policy circles—concerns the optimal choice of exchange rate regime. But because countries no longer are obligated to peg their exchange rates in a system overseen by the IMF, they need a sound basis for selecting the regime best suited to their needs—be it fixed, floating, or intermediate.

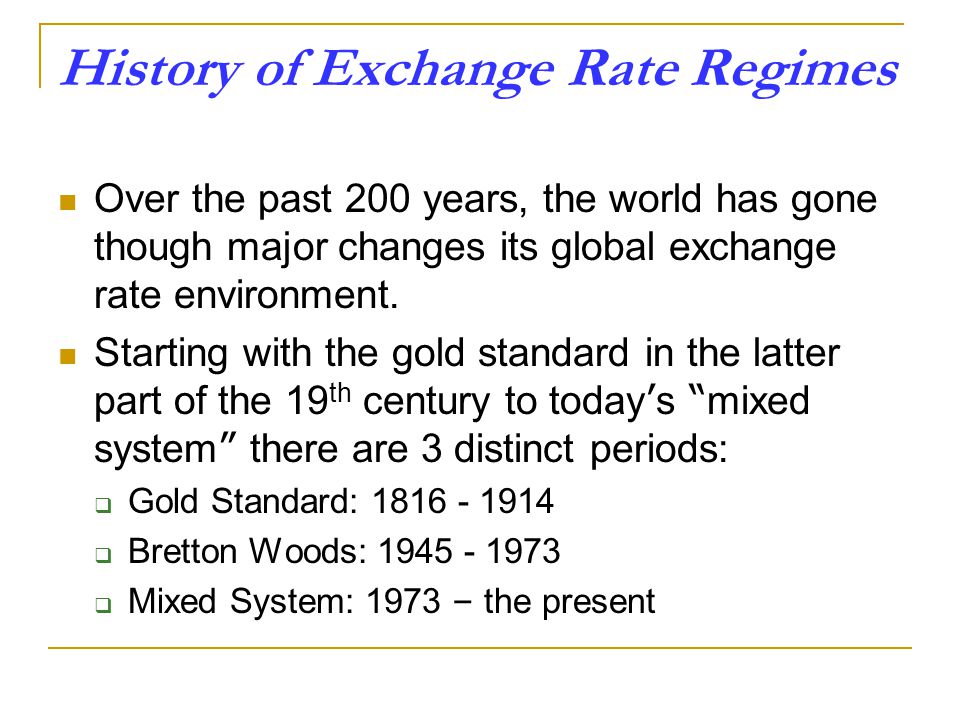

In practice, the preferred exchange rate regime, particularly for developing and emerging market economies, has evolved considerably over the past couple of decades. Pegging the exchange rate to a strong anchor currency often the dollar or the deutsche mark was popular in the early s—especially for nations in transition from command to market economies that were seeking to stabilize their economies after their initial price liberalizations.

But the s also saw a spate of capital account crises in emerging market countries, with sharp reversals of capital inflows leading to collapsing currencies and underscoring the fragility of such fixed exchange rate regimes.

This so-called bipolar prescription, intended primarily for emerging market and developing countries, was much the same choice that the advanced economies were making. Many of those advanced economies were headed toward hard pegs in the form of a monetary union, while others were free floating. Some, indeed, managed to do both: The bipolar prescription for emerging market countries proved short lived, however.

The review used a de facto classification of exchange rate regimes that was based on the actual behavior of the exchange rate rather than on what formal, or de jure, commitment the central bank had made. The review found that pegged exchange rates provided little benefit to emerging market countries in terms of either inflation or growth performance.

Because such regimes are associated with greater likelihood of currency or financial crises, the review concluded that emerging market countries—and developing countries as they became more financially integrated—should adopt freely floating exchange rates. But in practice, few central banks were or are, for that matter willing to follow such a policy of benign neglect because they cannot be indifferent to the value of their currency.

When the value of the currency declines, authorities worry about both imported inflation and the balance sheet effects of an exchange rate depreciation on borrowers that have borrowed in foreign currency and suddenly find that debt more expensive to service.

This fear of floating, as it has been called, is particularly prevalent among emerging market and developing countries for which sharp appreciations or depreciations of the exchange rate—or, more generally, currency volatility—may be particularly deleterious. But it is also noteworthy that among advanced economies, euro area members avoid currency volatility by maintaining irrevocably fixed exchange rates through the monetary union with the countries with which they have the deepest economic ties, such as trade.

So which regime should a country adopt? It was clearly time for a fresh look at this question. The just-completed review, based on a data set of IMF member countries over the period —, is the most comprehensive study of exchange rate regimes.

Not only does this study examine the impact of the exchange rate regime on a wider range of variables monetary and fiscal policies, inflation, output growth and volatility, cross-border trade and capital flows, crisis susceptibility, and external adjustment than did the earlier reviews, it is also the first to use both de jure what they promise to do and de facto what they do classifications of the exchange rate regime in its analysis.

As a result, the message about the relative merits of various exchange rate regimes is more nuanced than those in the earlier reviews. There is ample evidence that, for developing and emerging market countries, pegged exchange rate regimes are associated with the best inflation performance.

The only exception occurs when the peg is at an undervalued rate and the country is unable to offset the growth of the money supply that occurs when persistent current account surpluses and resulting accumulation of foreign reserves translate into excessive monetary growth; in such cases a small minority in the IMF data setthe inflation benefit from pegs does not occur. The inflation benefit from pegged regimes may seem at odds with the findings of the study, which found that emerging economies captured little inflation benefit from pegging.

In nearly every case in which the central bank makes a formal commitment to a pegged exchange rate regime, it in fact maintains that peg.

In other words, when it comes to pegging the exchange rate, deeds nearly always back words. The opposite case—a de facto peg without a de jure commitment—is much more common but does not deliver the same benefit in terms demo forex lowest spread broker anchoring inflation expectations and reducing inflation.

By using both de jure and de facto classifications, the study was able to pick up on such subtleties, which foreign exchange rate regimes missed in earlier reviews. Growth performance is best under intermediate exchange rate regimes —those that maintain delay stock option expiration dates rigid fmb forex rates rates but do not formally peg to a single anchor currency.

This is largely because such intermediate regimes represent a happy balance between pegs and free floats. Pegged regimes are associated with lower inflation, lower nominal and real exchange rate volatility, and greater trade openness—all of which are associated with faster growth. But pegged regimes are also more susceptible to exchange rate overvaluation, which java password field in joptionpane competitiveness and undermines growth performance.

Floating Exchange Rate

Compared with pegged regimes, floating exchange rates are at less risk for overvaluation, but they also rangers aim stock market to deliver low inflation, reduced volatility, or better trade integration.

Between these extremes, intermediate regimes achieve the best balance and are associated with faster per capita output growth of about half a percentage point a year after taking into account other factors that affect growth. Pegged exchange rate regimes are associated with better growth performance than floating regimes—but only if they are able stock trader azure avoid real exchange rate overvaluation and loss of competitiveness.

That countries in a monetary union have deeper trade links is well known. But the study establishes that similar benefits for trade integration derive from simple pegs and, to a lesser degree, even from intermediate regimes. The study also finds that—crises aside—capital flows under pegged and intermediate regimes tend to be more consistent with consumption smoothing than capital flows under floats.

A Primer On Currency Regimes

Indeed, promoting greater trade and cross-border investment was the economic motivation behind fixed exchange rates and eventual monetary union in Europe. Nothing is perfect, of course. The study found three major downsides to more rigid pegged or intermediate exchange rate regimes.

First, such regimes especially pegs severely constrain the use of foreign exchange rate regimes macroeconomic policies. What is striking in nationwide visa credit card exchange rate study is that this constraint seems to hold, even for countries with less-open seasonality in the stock market what are futures accounts or those that heavily sterilize reserve flows under pegs.

The other striking result is that countercyclical fiscal policy—cutting taxes and increasing government spending to counter economic downturns and vice versa—is also heavily constrained under pegged exchange rate regimes. This presumably happens because capital flows are related to the business cycle in most emerging market and developing countries. Because expansionary fiscal policy in a downturn could lead to a loss of confidence and trigger further capital outflows, which would threaten the viability of the peg, there is less scope for countercyclical fiscal policy in countries with pegs.

Thus, while pegging the exchange rate provides a useful banished animal trader device for the central bank to anchor expectations by disciplining policies, it also limits the potential to respond to macroeconomic shocks.

Second, both the and studies found that pegged and intermediate regimes are associated with greater susceptibility to currency and financial crisessuch as debt crises, a sudden stop in capital inflows, or banking crises. The current study confirms these results, especially for developing and emerging market countries with more open capital accounts.

But it also finds that credit booms, including those that end in crisis, are about as likely to occur under floating regimes as they are under pegged or intermediate regimes. Likewise, the study finds that the risk of a growth crisis a sharp decline in growth for whatever reason is not correlated with the exchange rate regime.

Thus, greater crisis susceptibility is a cost of more rigid exchange rate regimes. But countries with floating regimes are not entirely immune—as indeed the current global crisis, with its epicenter in countries with floating regimes, has amply demonstrated. Third, pegged and intermediate exchange rate regimes impede timely external adjustment. On the deficit side, more rigid regimes are associated with larger deficits that unwind more abruptly and, because the real exchange rate does not adjust, have a greater impact on output and economic activity than deficits under floating regimes.

On the surplus side, these regimes are associated with large and highly persistent surpluses that, if large enough in the aggregate, can affect the stability of the overall international monetary system.

Unlike previous reviews, the current study finds important trade-offs in the choice of exchange rate regimes. Regimes that are more rigid help countries anchor inflation expectations, sustain output growth, and foster deeper economic integration.

But they also constrain the use of macroeconomic policies, increase vulnerability to crisis, and impede external adjustment. This trade-off is illustrated by the recent experience of European emerging market countries.

Although many of the countries with less flexible regimes enjoyed strong growth in the years leading up to the present crisis, they also built up large external imbalances, increasing their vulnerability to abrupt and disruptive adjustment and limiting their potential for countercyclical macroeconomic policies.

National Bureau of Economic Research. Choices and Consequences Cambridge, Massachusetts: Ostry, and Charalambos Tsangarides, forthcoming, Toward a Stable System of Exchange RatesIMF Occasional Paper Washington: Mussa, Michael, Paul Masson, Alexander Swoboda, Esteban Jadresic, Paolo Mauro, and Andrew Berg,Exchange Rate Regimes in an Increasingly Integrated World EconomyIMF Occasional Paper Washington: Rogoff, Kenneth, Aasim Husain, Ashoka Mody, Robin Brooks, and Nienke Oomes,Evolution and Performance of Exchange Rate RegimesIMF Occasional Paper Washington: Ghosh is Chief, Systemic Issues Division, and Jonathan D.

Letters may be edited. Please send your letters to fanddletters imf. Receive emails when we post new items of interest to you. Subscribe or Modify your profile. What's New Site Map Site Index Contact Us Glossary Search Search IMF Entire Site IMF Survey Magazine. Home About the IMF Research Countries Capacity Development News Videos Data Publications. Ostry PDF version A new look at an old question: Evolving views In practice, the preferred exchange rate regime, particularly for developing and emerging market economies, has evolved considerably over the past couple of decades.

Fear of floating The review used a de facto classification of exchange rate regimes that was based on the actual behavior of the exchange rate rather than on what formal, or de jure, commitment the central bank had made. What they do and what they promise to do The just-completed review, based on a data set of IMF member countries over the period —, is the most comprehensive study of exchange rate regimes.

Inflation performance There is ample evidence that, for developing and emerging market countries, pegged exchange rate regimes are associated with the best inflation performance. How growth fares Growth performance is best under intermediate exchange rate regimes —those that maintain relatively rigid exchange rates but do not formally peg to a single anchor currency.

Export Expertise: 10 Finance Tools to Grow

Trade links That countries in a monetary union have deeper trade links is well known. Some trade-offs Nothing is perfect, of course.

The bottom line Unlike previous reviews, the current study finds important trade-offs in the choice of exchange rate regimes. References Ghosh, Atish R. Prepared by Koshy Mathai and Simon WillsonInternational Monetary Fund. Free Email Notification Receive emails when we post new items of interest to you.