How to buy copper on the stock market

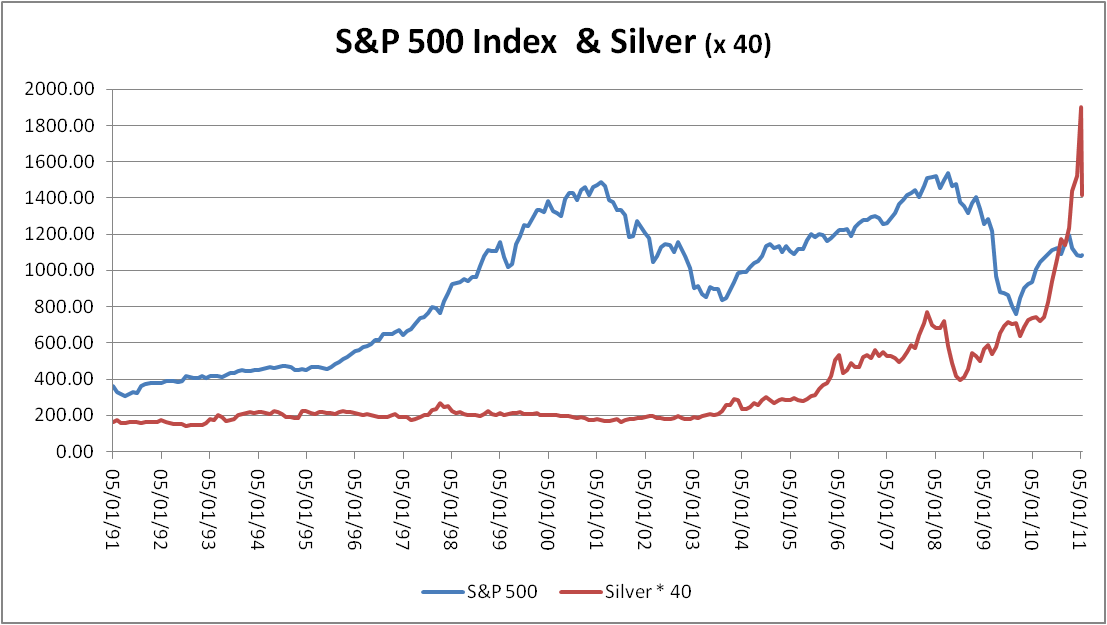

Copper has been known to mankind for thousands of years and has been an important metal in human development since it has similar properties as some, more expensive, metals. Copper is similar to silver and gold in many ways as the red metal is very ductile, malleable and it can very easily conduct heat and electricity. Copper is used throughout wiring systems as well as in plumbing and circuit boards as well.

In addition to copper wire and copper piping, the reddish-orange metal is used in power generation and transmission, heating and cooling systems, and telecommunications equipment, ensuring that the metal remains a crucial aspect of modern industrial life. There are a wide number of options for those seeking exposure to copper.

Investors have the option of buying up bars of copper or looking at some of the physically-backed ETPs that are currently on the market in some countries.

Additionally, investors also have the option of buying futures contracts of the metal which are extremely liquid. There are a number of ETPs that allow investors to gain exposure to the red metal via futures either in a basket or exclusively. Lastly, investors have the option of buying any number of companies that are focused on the mining of the metal or by looking at an ETF that invests in copper mining companies.

There are 4 ways to invest in Copper: ETFs, Futures, Physical, and Stocks. Click on the tabs below to learn more about each alternative. There are multiple options for investors looking to bet on copper prices, and exchange-traded products offer a nice choice for investors interested in low maintenance.

BRSS stock quote - Global Brass and Copper Holdings, Inc. Common Stock price - wunesajoc.web.fc2.com

Copper is included in several broad-based metal ETFs and ETNs, generally along with other industrial metals such as tin, aluminum, and lead. There is also a pure play option; the iPath Dow Jones- UBS Copper ETN JJC is linked to an index that consists of futures contracts on copper.

JJC delivers returns available through a futures-based strategy, to the ETN will not always match up perfectly with movement in spot prices. Also, it is worth considering that an investment in JJC exposes investors to the credit risk of the institution, as ETNs are debt instruments linked to the return of a particular asset class. International investors may have more options for exposure to copper through ETFs; in London, ETF Securities offers a physically-backed product that could be appealing to investors frustrated with the nuances of contango and backwardation.

There are also inverse and leveraged options for international investors. There are also options for accessing copper prices indirectly through stocks of companies engaged in production of the metal, and there are multiple ETFs focusing on this corner of the materials market.

The two primary options are the Global X Copper Miners ETF COPX and the First Trust ISE Global Copper Index Fund CU. Both invest in stocks of companies who derive revenue from the sale of copper, though COPX offers more of a pure play on copper miners. Copper futures are traded on the COMEX division of the NYMEX under the symbol HG. Each contract represents 25, pounds of copper; the basis for the contract is Grade 1 Electrolytic Copper Cathodes full plate or cut that conforms to the chemical and physical specifications for Grade 1 Electrolytic Copper Cathode as adopted by the American Society for Testing and Materials.

Trading in copper futures is conducted for delivery during the current calendar month, the next 23 calendar months, and any March, May, July, September, and December falling within a month period beginning with the current month. Physical delivery may take place on any business day beginning on the first business day of the delivery month or any subsequent business day of the delivery month, but not later than the last business day of the current delivery month.

Copper futures are also traded on the London Metal Exchange under the contract code CA. LME copper futures contracts are priced in dollars and cents per pound, and clearable currencies include the U.

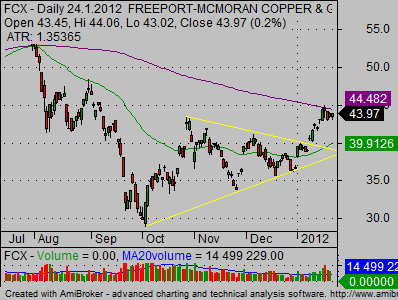

Top 5 Copper Stocks for (SCCO, FCX) | Investopedia

Investors seeking to gain exposure to copper can do so by simply buying the metal and storing it. Because copper is relatively cheap, however, storing copper of any material value may be challenging. There have been instances of people hoarding currency to gain exposure to copper. That prompted some to melt down the currency when copper prices rose to the point that the materials used to make the coin were more valuable than the coin itself.

Mtechtips Equity & Commodity Advisor-Online Commodity Tips-Stock Market Tips-Accurate Stock Tips-Accurate Commodities Tips-Comex Market

Since , pennies have been made from a mixture of zinc and copper. There are also exchange-traded products offering exposure to physical copper. The ETF Securities Physical Copper ETF , which trades on the London Stock Exchange under the ticker PHCU , is backed by physical metal stored at London Metal Exchange warehouses, the ownership of which is evidenced by LME warrants or warehouse receipts.

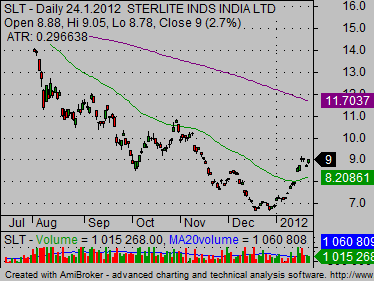

One option for establishing exposure to copper involves purchasing stocks of companies engaged in mining and selling the metal. Because the profitability of these firms depends on market prices for the metal, these stocks have been known to demonstrate a strong positive correlation to spot prices. Moreover, investing in stocks avoids the potential complexities of a futures-based strategy.

Many companies that mine copper are also engaged in mining for gold, nickel, and other precious and industrial metals.

There are, however, some pure play miners that focus primarily on copper:. For a longer list of copper mining companies, see the holdings of the Global X Copper Miners ETF. Subscribe to receive FREE updates, insights and more, straight to your inbox.

Commodities Industrial Metals Copper Copper. How to Invest in Copper. Ways to Invest in Copper There are 4 ways to invest in Copper: ETFs Futures Physical Stocks What are Copper ETFs?

What are Copper Futures? Copper futures are subject to NYMEX position limits. How to Buy Physical Copper Investors seeking to gain exposure to copper can do so by simply buying the metal and storing it. How to Buy Copper Stocks One option for establishing exposure to copper involves purchasing stocks of companies engaged in mining and selling the metal.

There are, however, some pure play miners that focus primarily on copper: Jiangxi Copper Company Freeport Copper Equinox Minerals Lundin Mining Corp XStrata PLC For a longer list of copper mining companies, see the holdings of the Global X Copper Miners ETF. Copper in the News. Metals Stare at Rising Prices. Q1 Earnings on Tap: Potash, Miners, and Agribusinesses Report. The Best and Worst Performing Commodities of Q1 Commodity Stock Hits And Misses. Housing Market Faces Potential Headwinds.

Copper vs. Aluminum: Stock Intel Heatsink RantCaterpillar's Earnings Highlight Mining Industry's Challenges. Global Commodities Weekly Roundup: June 15 Jun 15, June 8 Jun 08, June 1 Jun 01, May 25 May 25, Popular Topics Commodities Gold Silver.

ETFs SOXL AGG REET.