Financial market regulators in india

NSE - National Stock Exchange of India Ltd.

Financial sector regulators in India. Financial sector is backbone of the Indian economy as we need finance for each of the project that we want to accomplish. Some of the questions are asked relating the functions of the regulators of these financial institutions and their terms etc. The major regular of the financial market if Reserve bank of India which regulates all the type of banks in India which are responsible for financing each small and large projects.

The other is IRDA which is the regulatory authority for the Insurance sector. India has a lot of regulator and the case is correct for financial regulator as well.

WatersTechnology - global financial technology news and analysis

Here are some of the details about the financial regulator in India which candidates need to know. Candidates will need to know the various types of regulators which are prevailing in the country.

Candidates will get the questions related to financial regulators in various examinations. The banking awareness section in the written examination is merged with the general awareness section and there can be as many as 15 questions from this section. All those candidates who have been preparing for the banking examination need to know the details and have an overview of the regularities in India.

Here is the list of all the regulators which candidates need to know before they may appear for the examination. RBI is the financial regulator of all the financial institutions like public sector banks, private sector banks, RRBs, Cooperative banks and all type of Non banking financial companies etc. Here are some of the details which candidates need to know. RBI is the banker to the banks and banker to the government of India. It does various tasks and decides the policy rates which influences the growth and inflation in the country.

The basis aim of RBI is to control the inflation f the country keeping in mind the growth of the country.

Besides this it performs a number of functions like selling the government securities in open market etc. Insurance regulatory and development authority of India is the regulator of all Private sector insurance business and public sector insurance business in India. IRDA issues guidelines for various insurance companies and also decides the type of policy which can be issued by these insurance companies. It keeps an eye on the functioning of insurance companies to direct them to work in the public interest.

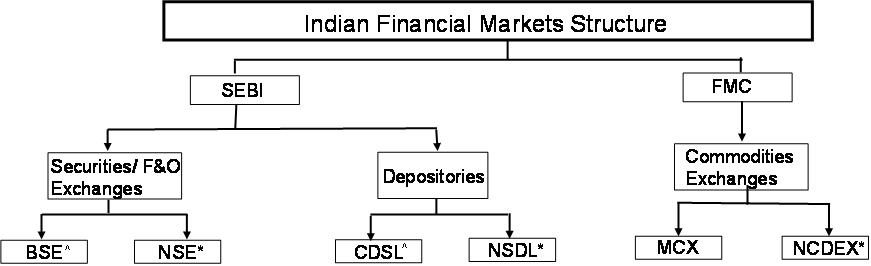

Securities and exchange board of India known as SEBI is the regulator of money market and stock market in India.

It protects the interest of investors who invests in various type of securities and money market in India. It directs the capital market and money market to work in the interest of general public.

It also regulates the foreign investments in Indian firms and businesses. It is required to have prior approval of SEBI to undertake any capital related business in India. National bank for agriculture and rural development is the apex unit for deciding the policy for RRBS, state owned cooperative banks, central cooperative banks etc.

Subscribe to read

It enhances the business in cotton industry, small scale industries generally located in rural areas etc. It takes policies for the financial health of rural areas in accordance with the RBI. Pension fund regulatory and development authority of India is the organization which decides what funds have to be invested in what securities and based on the interest paid on these funds it decides the rate for public provident fund and also it provides old age securities to the people.

It is the regulator of all the pension related organization of the country. Banking and insurance are closely related to India. While the banking is flourishing in India the insurance sector has not got the pace that was expected from it. The government is trying to sell various insurance products through the banking sector now.

And many private firms and private banks also with the joint venture of foreign entities are selling the insurance policy in India. The government is trying to improve the penetration by selling more and more insurance products to the existing and new customers.

Here are some useful details. RBI is the Regulatory author for all the banks and the private financial institutions in India.

It also performs several functions and control the important policy rates to control the inflation and the growth of the economy. Generally there is one government who is the head of the Reserve bank of India and there are 4 deputy governors which assist the governor and helps in important decision making.

IRDA is also an important regulatory ody in India for the insurance sector. Any company who want to come in the filed of insurance in India will need the approval of the IRDA to star its business. It makes the guidelines for the Insurance sector to work. This is also the main regulatory authority for the capital market in India and all te major projects need the long term capital which are funded by it.

Regulatory Body- Financial Regulatory Bodies In India | Economy Watch

It regulates the capital market. Your email address will not be published. Home Preparation tips General Awareness Banking Awareness Computer Awareness interview preparation. NABARD Grade B officers recruitment 21 hours ago. Ahmednagar district central cooperative bank recruitment 21 hours ago. Ganesh Prasad Tripathy January 8, at 9: Leave a Reply Cancel reply Your email address will not be published.

We Collected Information from Different Sources. We Request You to Check with the Official Web Site for the correctness.