Level 2 option trading td ameritrade

Call Options Put Options Implied Volatility Basic Strategies The Options Playbook TastyTrade Helpful Page CBOE Options Institute CBOE Webcasts CBOE Index Settlement Values Streaming Futures Quotes Economic Calendar. Users tagged with 'Options Pro' flair have demonstrated considerable knowledge on option trading. Some have professional experience, but the tag does not specifically mean they are professional traders.

Tier 3 options privileges at TDAmeritrade self. Anyone here have tier 3 privileges ability to sell naked options at TD? Do they really make decisions based on just the info you provide in their upgrade form? Is there a certain minimum account value you need before they'll even consider your application?

Yes, all they look at is your unverifiable responses to the survey questions in your margin application I have max options privileges with TDA. Think they have 4 tiers in total. But I was carried over from thinkorswim when TDA bought them out.

At the time they only cared about income, experience and net worth. I had a job at the time so I was granted everything, max options, futures, forex etc. I was initially denied when I opened my account but I sent them a letter through their message center and was then approved.

My account was low six figures. With less money you may need to lie on the application but sending a letter saying you understand the risks may be enough. They are mostly interested in covering themselves so a signed letter saying you know what you are doing protects them from you suing due to lack of suitability.

Use of this site constitutes acceptance of our User Agreement and Privacy Policy.

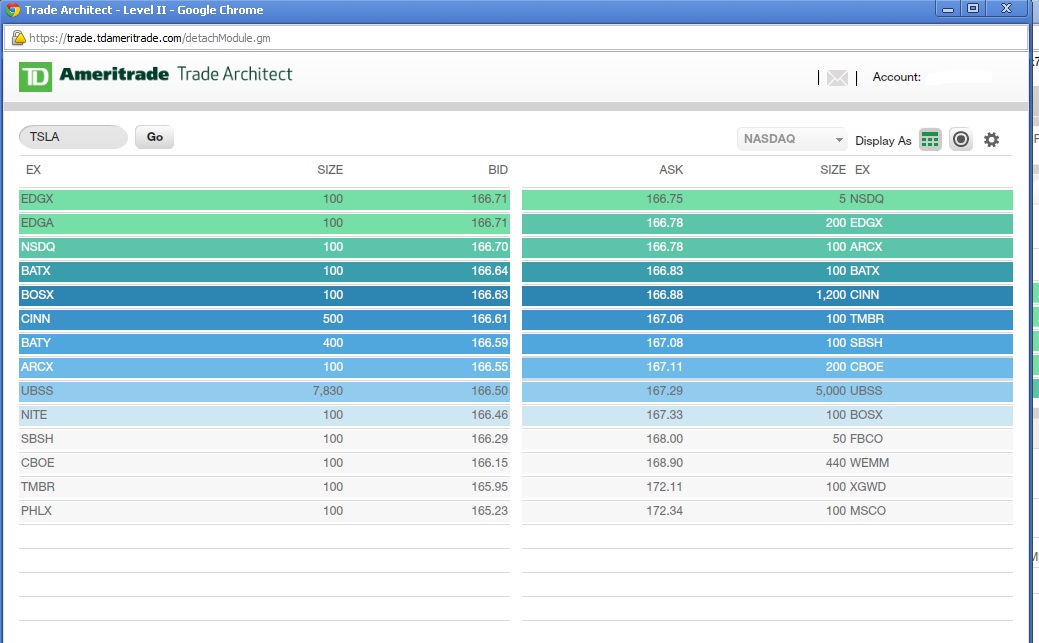

TD Ameritrade Level 2 Quotes

By signing up, you agree to our Terms and that you have read our Privacy Policy and Content Policy. Log in or sign up in seconds. Submit a new link.

thinkorswim Mobile on the App Store

Submit a new text post. Call Options Put Options Implied Volatility Basic Strategies The Options Playbook TastyTrade Helpful Page CBOE Options Institute CBOE Webcasts CBOE Index Settlement Values Streaming Futures Quotes Economic Calendar Option Pros: Generic method of calculating margin requirements outside of a specific strategy. Can't find anything from Googling. I have a bullish thesis on the market over the next 3 months.

Would it be more profitable to go long the 3 month call options or 3 month futures? This is an archived post. You won't be able to vote or comment. Posts are automatically archived after 6 months.