Art forex scalping

Forex scalping is a popular method involving the quick opening and liquidation of positions. The popularity of scalping is born of its perceived safety as a trading strategy. Many traders argue that since scalpers maintain their positions for a brief time period in comparison to regular traders, market exposure of a scalper is much shorter than that of a trend follower, or even a day trader, and consequently, the risk of large losses resulting from strong market moves is smaller.

Indeed, it is possible to claim that the typical scalper cares only about the bid-ask spread, while concepts like trend, or range are not very significant to him. Although scalpers need ignore these market phenomena, they are under no obligation to trade them, because they concern themselves only with the brief periods of volatility created by them. Forex scalping is not a suitable strategy for every type of trader. The returns generated in each position opened by the scalper is usually small; but great profits are made as gains from each closed small position are combined.

Scalpers do not like to take large risks, which means that they are willing to forgo great profit opportunities in return for the safety of small, but frequent gains.

Consequently, the scalper needs to be a patient, diligent individual who is willing to wait as the fruits of his labors translate to great profits over time. Scalping also demands a lot more attention from the trader in comparison to other styles such as swing-trading, or trend following.

A typical scalper will open and close tens, and in some cases, more than a hundred positions in an ordinary trading day, and since none of the positions can be allowed to suffer great losses so that we can protect the bottom line , the scalper cannot afford to be careful about some, and negligent about some of his positions.

It may appear to be a formidable task at first sight, but scalping can be an involving, even fun trading style once the trader is comfortable with his practices and habits. Still, it is clear that attentiveness and strong concentration skills are necessary for the successful forex scalper. One does not need to be born equipped with such talents, but practice and commitment to achieve them are indispensable if a trader has any serious intention of becoming a real scalper.

Scalping can be demanding, and time-consuming for those who are not full-time traders. Many of us pursue trading merely as an additional income source, and would not like to dedicate five six hours every day to the practice. In order to deal with this problem, automated trading systems have been developed, and they are being sold with rather incredible claims all over the web.

However, if you design your own automated systems for trading with some guidance from seasoned experts and self-education through practice it may be that you shorten the time which must be dedicated to trading while still being able to use scalping techniques.

And an automated forex scalping technique does not need to be fully automatic; you may hand over the routine and systematic tasks such as stop-loss and take-profit orders to the automated system, while assuming the analytical side of the task yourself. This approach, to be sure, is not for everyone, but it is certainly a worthy option.

Finally, scalpers should always keep the importance of consistency in trade sizes while using their favored method.

Forex Scalping Guide

Using erratic trade sizes while scalping is the safest way to ensure that you will have a wiped-out forex account in no time, unless you stop practicing scalping before the inevitable end. Scalping is based on the principle that profitable trades will cover the losses of failing ones in due time, but if you pick position sizes randomly, the rules of probability dictate that sooner or later an oversized, leveraged loss will crash all the hard work of a whole day, if not longer.

Thus, the scalper must make sure that he pursues a predefined strategy with attention, patience and consistent trade sizes. This is just the beginning, of course, but without a good beginning we would diminish our odds of success, or at least reduce our profit potential. Our suggestion is that you peruse all of this article and absorb all the information that can benefit you. How scalpers make money: Choosing the right broker for scalping: Not every broker is accommodative to scalping.

Sometimes this is the stated policy of the firm, at other times the broker creates the conditions which make successful scalping impossible. Best currencies for Scalping: There are currency pairs where scalping is easy and lucrative, and there are others where we advise strongly against the use of this strategy.

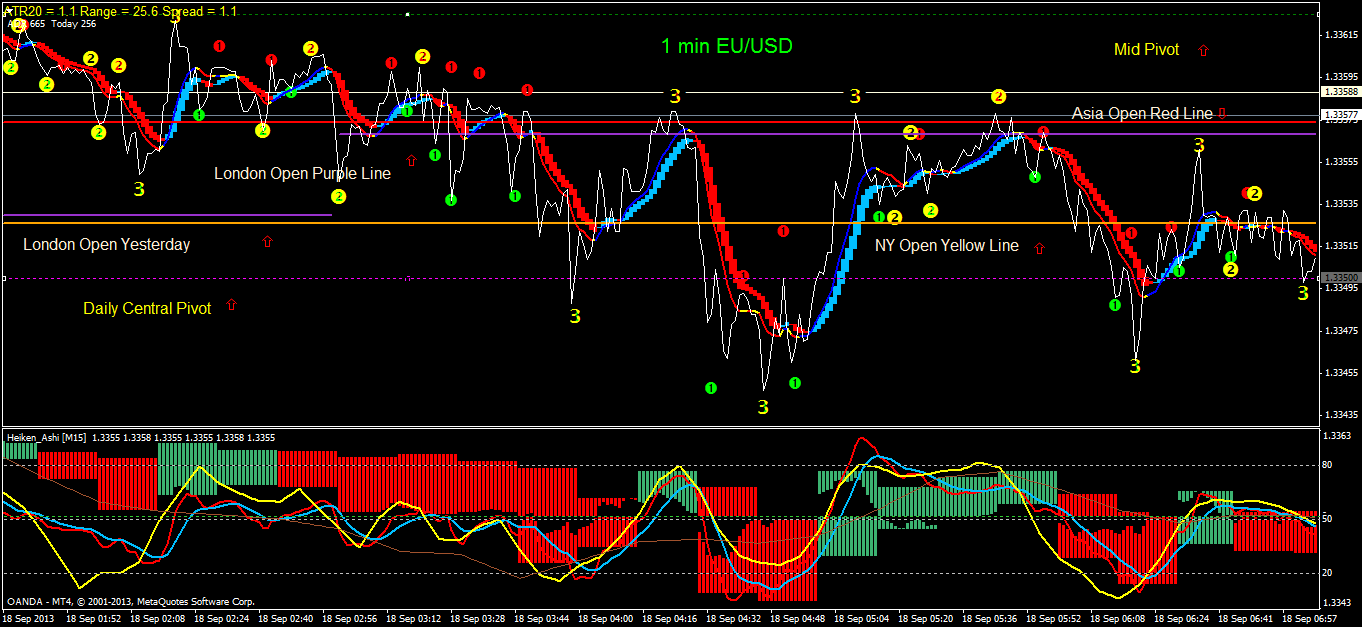

Best times for Scalping: There is an ongoing debate about the best times for successful scalping in the forex market. Strategies in scalping need not differ substantially from other short-term methods. On the other hand, there are particular price patterns and configurations where scalping is more profitable.

Some traders consider ranging markets better suited for scalping strategies. Trend Following while Scalping: Trends are volatile, and many scalpers choose to trade them like a trend follower, while minimizing the trade lifetime in order to control market risk.

Disadvantages and Criticism of Scalping: Scalping is not for everyone, and even seasoned scalpers and those committed to the style would do well to keep in mind some of the dangers and disadvantages involved in using the style blindly. Trading Foreign Exchange on margin carries a high level of risk and may not be suitable for all investors.

The Best Forex Brokers for Scalping

The possibility exists that you could lose more than your initial deposit. The high degree of leverage can work against you as well as for you. OptiLab Partners AB Fatburs Brunnsgata 31 28 Stockholm Sweden Email: You are using an outdated browser.

Please upgrade your browser to improve your experience. World's best forex deals and strategy. Is Forex Scalping for you? Attention is essential for the forex scalper Scalping also demands a lot more attention from the trader in comparison to other styles such as swing-trading, or trend following. Automated trading systems Scalping can be demanding, and time-consuming for those who are not full-time traders.

The Art of Scalping | Elite Trader

Some words on trade sizes and forex scalping Finally, scalpers should always keep the importance of consistency in trade sizes while using their favored method. Using Fibonacci Levels for Scalping the Forex Market.

Two different scalping strategies, two different timings. How forex scalpers make money. Forex Scalping Guide - Conclusions. Forex Scalping - Criticism and Disadvantages.

The Best Times for Scalping Forex. The Best Forex Brokers for Scalping. The Best Currencies for Scalping Forex. Sign Up Free Demo.