Market depth trading strategy

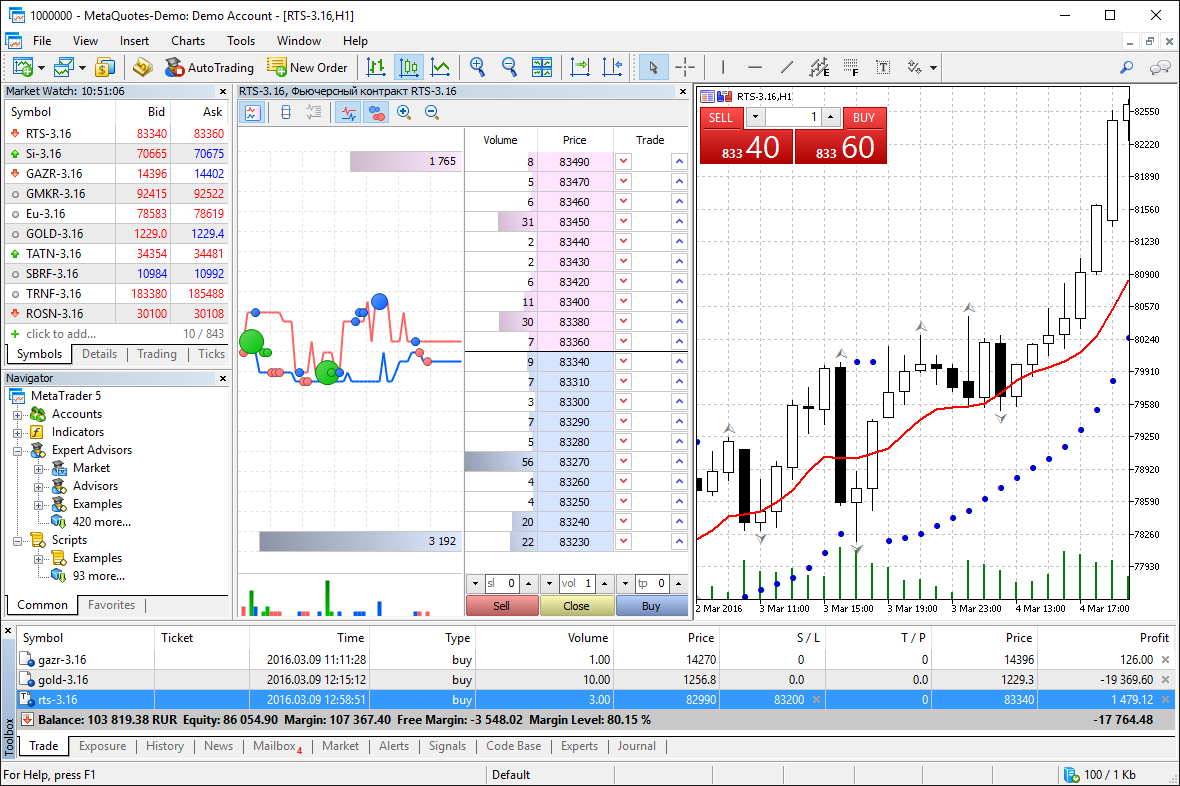

What is market depth and how do you use it to buy and sell shares? Market depth lists all buy and sell orders in the market for a particular security. If you wish to see if there is sufficient liquidity to sell a particular security, you can quickly check how many orders exist, and at which prices.

This is particularly important for certain interest rate securities and warrants, where liquidity can be low.

This is what market depth looks like on the CommSec site. The market depth is split into those wanting to buy and those wanting to sell. Buyers are on the left and sellers on the right. Notice that the buying price increases as we go from the bottom of screen to the top. On the sell side, the price decreases from the bottom to the top.

The buyers are moving closer to the sellers or the current market price and vice versa. The middle column is quantity. These are the total number of shares in the market and the total number of shares to be bought and sold at each price level. The outer columns show the number of buyers and sellers in the market and the number of buyers and sellers at each price level.

Both traders and investors look at market depth to examine the different prices and volumes bid and ask volumes of orders accumulating below and above the market bid and ask prices. Securities with good depth will be relatively liquid, and large orders will not affect price significantly.

On the other hand, securities with poor depth are more likely to have their price affected by large orders to buy and sell. Traders usually try to profit from short-term price volatility with trades lasting anywhere from several seconds to several weeks. Investors tend to purchase stocks with the intention of holding for an extended period of time, usually several months to years.

Liquidity is important to both traders and investors, but more so for traders as they hold positions for a shorter period of time and may need to liquidate their position immediately.

Some people tell me that you can use the market depth to see support and resistance for a stock. How does this work? As I mentioned previously, market depth lists all buy and sell orders in the market for a particular security.

Traders can identify, via the market depth, when there are more sell orders entered into the market than buy orders. When this happens the share price tends to weaken under selling pressure. The reverse is also true. When there are more buy orders being entered into the market than sell orders, the share price tends to gain strength with buying support.

Support and resistance is a concept in technical analysis whereby the price of a security will tend to stop and reverse at certain predetermined price levels. Traders and technical analysts or chartists believe support and resistance levels can be identified by trend lines.

A support level is a price level where the price tends to find support as it is going down.

Market depth trading strategy ~ wunesajoc.web.fc2.com

This means the price is more likely to "bounce" off this level rather than break through it. However, once the price has passed this level, even by a small amount, it is likely to continue dropping until it finds another support level. A resistance level is the opposite of a support level. It is where the price tends to find resistance as it is going up. However, once the price has passed this level, even by a small amount, it is likely that it will continue rising until it finds another resistance level.

To find out more please visit the ASX charting library. By Matt Comyn, General Manager, CommSec. The information contained in this article is general in nature and does not take into account any investor's particular objectives, financial situation or needs.

In considering its appropriateness, investors should consult a financial adviser before making an investment decision.

The example of Woodside Petroleum WPL for the market depth provided, is for informational purposes only and does not purport to give a buy, sell or hold recommendation. TheBull's free daily and weekly newsletters.

Click here to receive TheBull's free weekly newsletters on stocks, trading, investing and more. Ten's troubles put focus on Seven and Nine.

Long, hard road back for Ten. The impact of technology on the investment landscape The investment landscape has changed over the last few decades as technology has worked its way into all aspects of the field. ASIC beefs up fight against insider trading, but will convictions flow?

The Australian Securities and Investments Commission is moving to "real-time" monitoring of share trading as another weapon in the ongoing fight against insider trading. Will such a sentence really deter others who might be tempted to engage in insider trading? More NEED TO KNOW TERMS. Practise crafting your CFD trading strategies. Discover prices as low as AUD 7. Access Australian stocks and global markets with SaxoTraderGO.

Bid directly into ASX IPOs.

How to Scalp Using Market Depth on the Price Ladder

Trilogy Funds invites you to register your interest in our upcoming unlisted property trust. Thursday 22 June, 1: Market Summary Charts Code Lookup. Investing Trading Superannuation News Stocks Property. Share Trading CFDs Forex Brokers Margin Lenders Options Brokers Warrants Brokers Forums Newsletters.

Best Forex Signals | Free Forex Signals | Trading Signals | wunesajoc.web.fc2.com

Contact Us Journalists About Us Privacy Policy Terms of Use Bookstore Video asiadata. Share Trading question What is market depth and how do you use it to buy and sell shares?

Strategy for trading using Market depth in futures market (not level 2) -Suggestions?

TheBull weekly newsletter - FREE! More RELATED ARTICLES The impact of technology on the investment landscape The investment landscape has changed over the last few decades as technology has worked its way into all aspects of the field.

Cannon Hill Office Trust. Healthy ASX debut for Oliver's fast food 2. Retail Food Group cuts profit forecast 3. After toppling Apple in China, Oppo eyes world market 4. QBE hammered for offshore claims blowout 5. Share market posts biggest fall of 6. Growers at Bordeaux winefest unite against climate Biggest home prices fall in 18 months 2.

CommSec Daily Report Thursday 3. Tax perks for share traders 4. Stocks to watch 5. Residential property beyond the rear view mirror 6. We all enter contracts every day, so why are they Submissions want super tax concessions cut: Takeover - Foreign Investment and the Australian Psyche 5.

Not eating things 3. A recipe for disaster 4. Home Premium IPOs Data Articles Compare Experts Terms About Advertise. About us Advertise Contact us Privacy policy Terms of use.