How to calculate the intrinsic value of a stock option

When a private company's is sold, its value is ultimately determined by the highest and best price a buyer is willing to pay, but most private companies never sell percent of the company to an external buyer. They either shut down and distribute assets to their owners, sell one owner's stake to another, bring in outside investors, or establish and "sell" to an employee stock option plan.

With these options, understanding the nuances between market and intrinsic value becomes important. A company's market value is based on the expectation today of the company's future financial and operational performance.

In layman's terms, market value involves the expectation of a cash payout at some point in the future and an evaluation of how risky that payout will be. For small private companies, the market value is what investors or buyers would be willing to pay to buy all or a portion of your company.

Stock market values are typically the sum total of the stock price multiplied by the amount of stock outstanding. For large, publicly held companies, the price is easily determined because the stock is traded on the stock market, but for private companies the closely held stock price is more difficult to determine. Market value also looks at the value of a company's assets as a going concern.

These assets are valuable alone, but they have even more value as a tool for profit generation.

Stock option expensing - Wikipedia

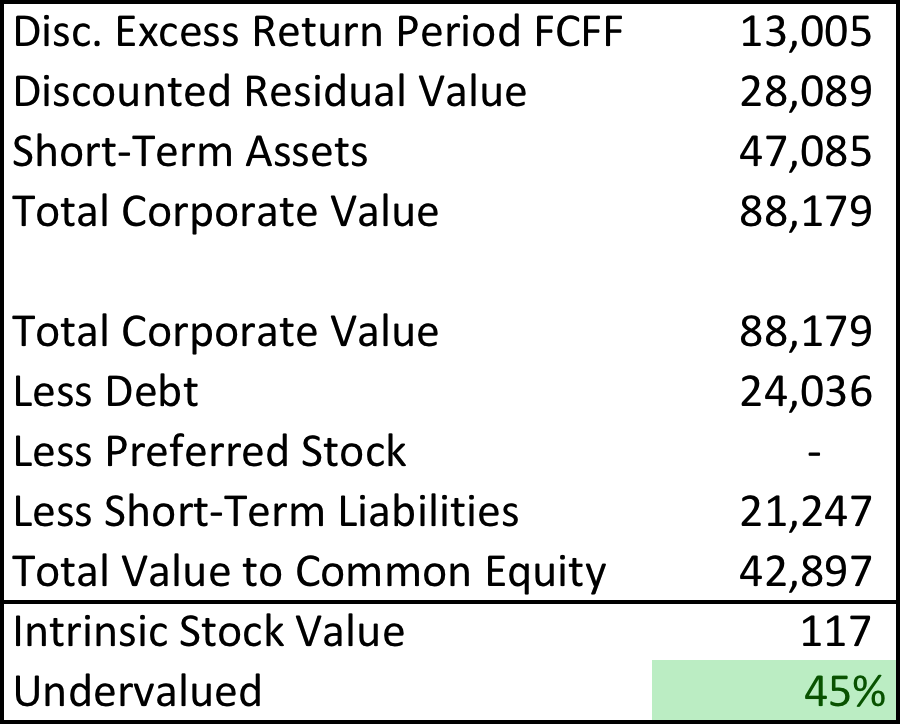

This value equals the market value of the company's debt and equity. In contrast, intrinsic value is the fundamental value, which is generally not something that is readily provable. Intrinsic value is usually internal or private estimates of your company's value or worth. It is the value determined by incorporating all applicable information and data necessary to value your company, whether that information is generally available or only known to your company's insiders.

For example, all five of a company's shareholders may have differing ideas of their corporation's intrinsic value. If asked to provide an estimate of that number with support, all would do so, but most likely with varying results. Market value method delete node binary search tree java generally driven by public, or external, opinions and expectations, whereas intrinsic value is driven by private, or internal, opinions and expectations.

A company's financial goal is to maximize shareholder wealth, how to calculate the intrinsic value of a stock option the company is public or private. This wealth refers to intrinsic value because the market value may or may not, at any given time, fully reflect a company's value. With private companies, fewer people hold the shares, so the intrinsic value may be much higher than the market value.

A company can counter this when seeking additional investors by using an investment bank or public relations firm to actively publicizing the company and its achievements. Wright has been writing since She is a business owner, interim CEO and author of "Solving the Capital Equation: Financing Solutions for Small Businesses.

She holds a master's degree in finance and entrepreneurial management from the Wharton School of the University of Pennsylvania. Skip to main content. Wright Market value for public companies is easily determined.

Market Value A company's market value is based on the expectation today of the company's future financial and operational performance. Market Value of Stock Stock market values are typically the sum total of the stock price multiplied by the amount of stock outstanding.

Intrinsic Value In contrast, intrinsic value is the fundamental value, which is generally not something that is readily provable. Differences Market value is generally driven by public, or external, opinions and expectations, whereas intrinsic value is driven by private, or internal, opinions and expectations.

References 2 Wichita State University - Dr. Introduction to Corporate Finance Macrothink Institute: An Empirical Mean-Reversion-Based Study. About the Author Tiffany C. Suggest an Article Correction.

More Articles [Perceived Risk] Types of Perceived Risk [Fair Market Value] How to Determine the Fair Market Value of Assets [Real Asset] Financial vs. Real Asset [Factors] Factors to Consider When Choosing a Method of Financing a Business.

What Is The Intrinsic Value Of A Stock?

Also Viewed [Balance Sheet Statement] What Factors Would Affect the Value of a Company's Assets on the Balance Sheet Statement? Book Value] Fair Value Vs.

Logo Return to Top. Contact Customer Service Newsroom Contacts. Connect Email Newsletter Facebook Twitter Pinterest Google Instagram. Subscribe iPad app HoustonChronicle.