Breakout trading in forex a low risk high reward strategy

There's no greater feeling than finding a highly volatile stock this strategy can be used on any asset that is volatileand when it pauses you know exactly how you will trade it when it starts its next big move.

To capitalize on these opportunities you need to know several things, including how to find a volatile stock that is worth trading, when to implement this triangle day trading strategy, and how to actually trade the strategy when everything aligns. This is because the triangle shows a slow down in the price action.

Vantage Point Trading | Effective and Simple Forex StrategiesEffective and Simple Forex Strategies

On the other hand, if a stock moves around a lot then a triangle is an anomaly. There are a number of ways to find volatile stocks, see: Find Day Trading Stocks with the Biggest Moves Using These Filters.

Using a volatile stock or other asset greatly increases the chances of success using this strategy.

If a typically volatile stock is not moving a lot on a particular day, then avoid this strategy. Triangles must be preceded by volatility, which helps indicate that the volatility will continue after the triangle completes. An ascending triangle is when the swings emerging market equity market cap are at the same price, but the second swing low is higher than the previous horizontal upper trendline, ascending lower trendline.

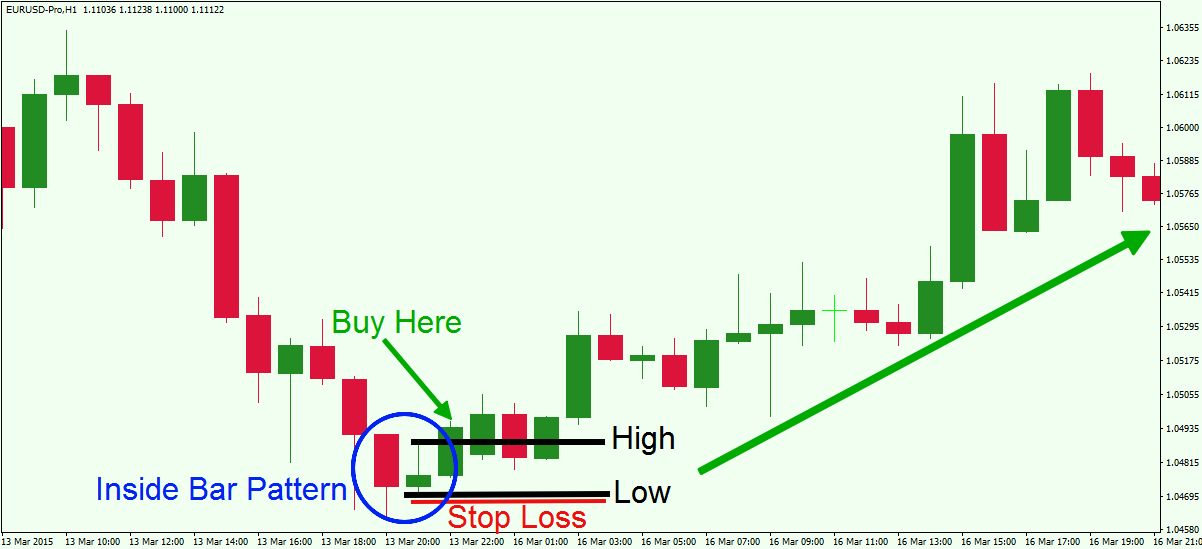

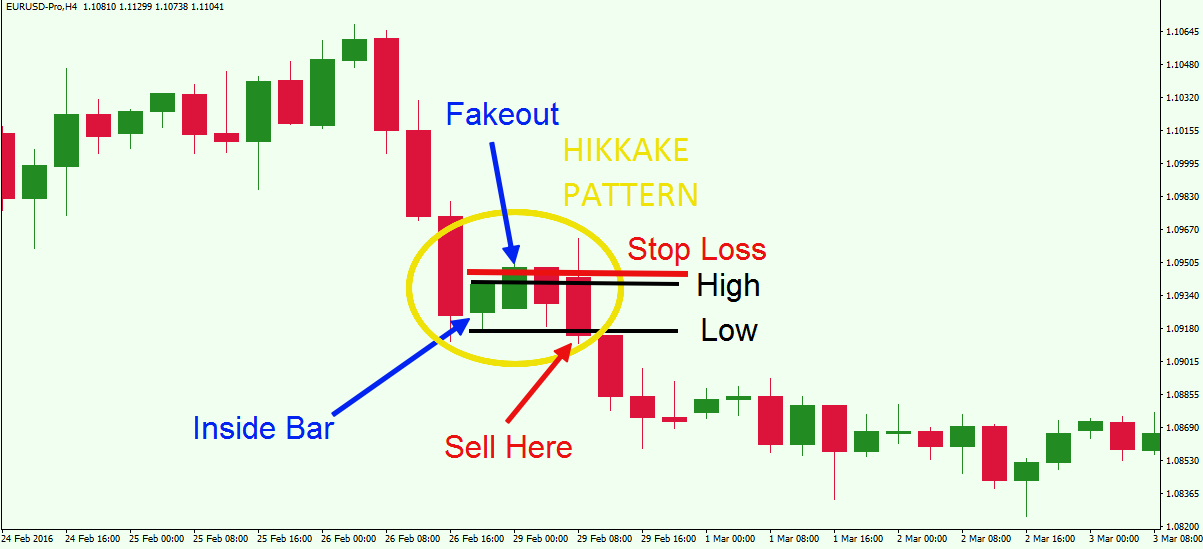

Make sure there breakout trading in forex a low risk high reward strategy strong movement before the triangle forms. As soon as you see a triangle pattern forming, draw the trendlines. If the price breaks below the lower triangle trendline, sell and place a stop loss above the most recent swing high. To calculate a profit targettake the height of the pattern high point minus low point and add it to the breakout price in the case of breakout trading in forex a low risk high reward strategy upside breakout, or subtract the height from the breakout price in the case of a downside breakout.

Set the stop loss immediately, then put out your target order once it's calculated.

Triangles are often seen during the U. Hunting for triangles during the lunch hour--in stocks that have been volatile in the morning--is a worthwhile endeavor. The target is an estimate, not an exact science.

Before taking a trade, note the amount you have at risk, and the potential profit based on the triangle height. Only take trades if the reward is twice as much as the risk, or more.

Breakout Trading In Forex, A Low Risk High Reward Strategy

In the depicted example, the profit was three times greater than the risk. Isolating these patterns in real time takes practice. Practice in a demo account --trading the breakouts, placing stop losses and quickly calculating the targets.

Want another strategy, for trading trends? See Engulfing Candle Day Trading Strategy. Search the site GO.

Low Risk High Reward Triangle Day Trading Strategy

Day Trading Trading Systems Basics Trading Psychology Trading Strategies Stock Markets Risk Management Forex Technical Indicators Options Glossary. Updated October 13, Get Daily Money Tips to Your Inbox Email Address Sign Up. There was an error.

Please enter a valid email address.

Personal Finance Money Hacks Your Career Small Business Investing About Us Advertise Terms of Use Privacy Policy Careers Contact.