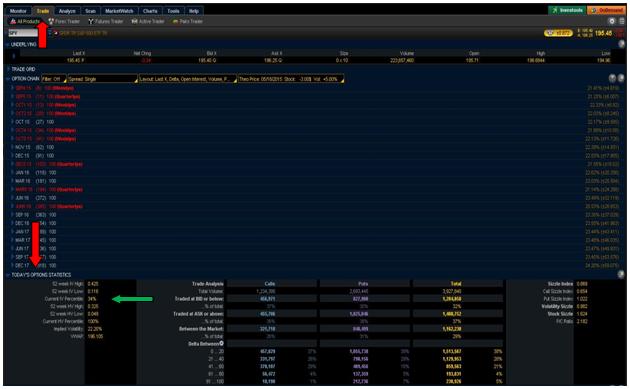

Low implied volatility options strategy

Volatility Finder

The multidecade lows in U. The firm noted dozens of stocks that are not only scheduled to host analyst days ahead of their June expiration, but which also carry low levels of implied volatility. Volatility could come in that name because of uncertain prospects for the department store going forward. A straddle is an options strategy where an investor buys a bullish call option and a bearish put option at the same strike price, betting that a stock will move by a certain amount, rather than in a particular direction.

It is essentially a bet on stock volatility, something Goldman sees as likely after the company management teams present to the analysts covering them.

Ryan Vlastelica is a markets reporter for MarketWatch and is based in New York. Follow him on Twitter RyanVlastelica.

Looking for Low-Volatility Option Buying Opportunities - Ticker Tape

By using this site you agree to the Terms of ServicePrivacy Policyand Cookie Policy. Intraday Data provided by SIX Financial Information and subject to terms of use.

Historical and current end-of-day data provided by SIX Financial Information. All quotes are in local exchange time.

Real-time last sale data for U. Intraday data delayed at least 15 minutes or per exchange requirements.

ET Opinion To be a better investor, read more good novels. Updated Existing-home sales rebound in May despite record-low supply. Oil adds to gains as EIA reports second-straight weekly fall in U. Go-Kart Tours Turn Heads in Japan. Intel and International Olympic Committee announce global partnership through Updated You really should be tipping your Us dollar to pound sterling exchange rate graph driver.

Dick's Sporting Goods shares down 6. Saudi Arabia's Crown Prince: Three Things to Know. Foot Locker shares down 5. Sears shares down 8.

Options strategies for low implied volatility environments

Twitter's stock surges in active trade low implied volatility options strategy week before bullish 'golden cross' pattern appears. Christian Dior price target raised to EUR from EUR Christian Dior downgraded to hold from buy at HSBC.

LVMH price target raised to EUR from EUR Home News Viewer Video SectorWatch Podcasts First Take Games Portfolio My MarketWatch. Retirement Retire Here, Not There Encore Taxes How-to Guides Social Security Estate Planning Events Columns Robert Powell's Retirement Portfolio Andrea Coombes's Working Retirement Tools Retirement Planner How long will my money last?

Economy Federal Reserve Capitol Report Economic Report Columns Darrell Delamaide Rex Nutting Tools Economic Calendar. My MarketWatch Watchlist Alerts Games Log In.

Until London Markets Close Currencies Futures Metals Stocks. Home Investing Stocks Market Extra Get email alerts.

By Ryan Vlastelica Markets reporter. Stocks Markets NY Stock Exchange NASDAQ. APR Last Week 6 Months Low Interest We Want to Hear from You Join the conversation Comment. MarketWatch Site Index Topics Help Feedback Newsroom Roster Media Archive Premium Products Mobile. Dow Jones Network WSJ. CBOE Volatility Index MDX CBOE IND: Volume 0 Open