Correlation between inflation stock market

Home Companies Industry Politics Money Opinion Lounge Multimedia Science Education Sports More Technology Consumer Specials Mint on Sunday. People Results Management Start-ups Financial Services Manufacturing Retail Telecom Infotech Infrastructure Education World Reports Agriculture Marketinfo Mint 50 Mark to Market Markets Ask Mint Money Calculators Mediclaim Ratings Views Online Views Columns Quick Edit Blogs Lounge Business of Life Slideshows Videos Technology Videos Marketing Research Personal Tech Media Advertising Enterprise Tech Gadgets Tech Reviews Technology Apps Education Health Cricket Athletics FootBall Tennis Olympics Others.

Inflation's Impact on Stock Returns | Investopedia

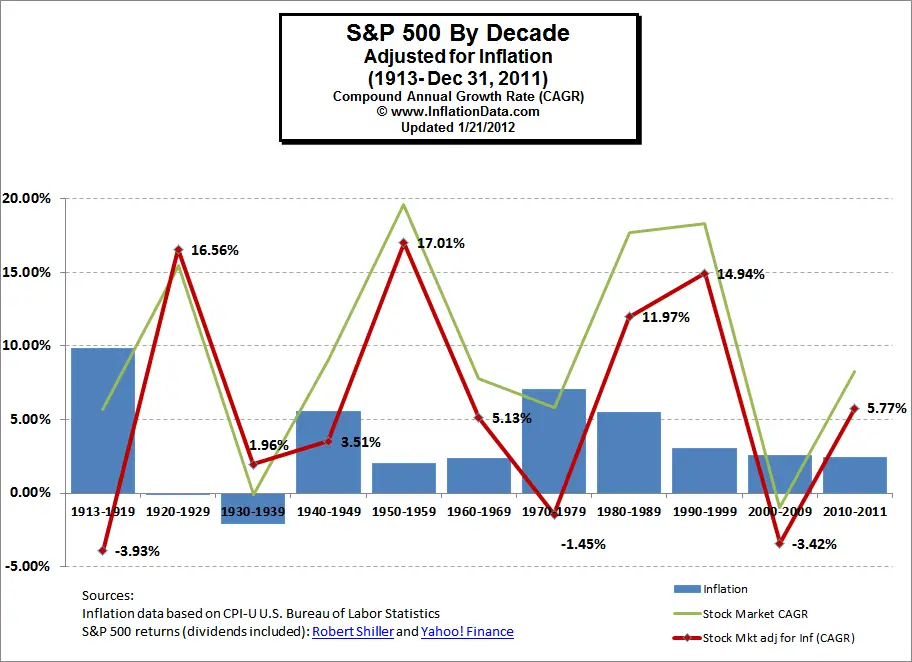

Inflation Stock Market Emami US Money Matters. Mark To Market Manas Chakravarty and Mobis Philipose. Wed, Jun 04 One of the strongest arguments for investing in stocks is that they provide protection against inflation. Is there a similar correlation between inflation and the Indian stock market?

Well, inflation based on wholesale price index WPI was at a very low 1. Or, consider , when the inflation rate had fallen to 4. Yet, between March and March , the Sensex moved up just a tad, from 3, to 3, Now consider periods of high inflation.

In March , WPI inflation was at The Sensex fell from 3, to 3, over the period. The data seem to show that the Sensex has little correlation with WPI inflation.

Does the kind of inflation make a difference? The argument that stocks are an inflation hedge is based on the premise that companies are able to raise prices during inflationary times, protecting their earnings.

On the other hand, if input prices rise more than that for manufactured goods, then margins will be squeezed.

Well, fuel price inflation was at And back in , in spite of big increases in inflation for primary articles and for fuel, the stock market rallied. Could it be growth? Not really—gross domestic product GDP growth was 7. Yet, when GDP growth fell to 4.

Inflation and the stock market - Livemint

Could it be interest rates? The year yield on the benchmark government bond fell from On the other hand, the year yield went up from 5. And as we can see today, the lagged effect of rising interest rates did impact earnings in the interest-rate sensitive sectors, which affected stocks in those sectors.

Second, inflation should be falling.

Third, valuations should be reasonable. And as far as the Indian market is concerned, that valuation has usually depended on foreign fund inflows. Liquidity, rather than domestic fundamentals,has been the main determinant of returns in the Indian market.

How Much Do Interest Rates Affect the Market’s Price-To-Earnings Ratio? - Sure Dividend Sure Dividend

Emami Ltd has grown its net profit by as much as It has offered minority investors a slightly higher price Rs7, a share. But another promoter group, which manages the company, is likely to stay put and the acquisition may not be smooth. All this makes the acquisition look expensive.

Emami operates with negligible debt Rs38 crore at the end of March , generates strong cash flow and should therefore manage the acquisition cost fairly well.

But the key issue is whether shareholders will be willing to budge. Home Companies Opinion Industry Politics. Consumer Lounge Multimedia Money Science.

Education Sports Specials Technology Mint on Sunday. Contact Us About Us Advertising Sitemap Subscribe. Mint Apps Shine Hindustantimes Syndication DesiMartini. Privacy Policy Terms of Use Mint Code RSS.